Introduction To Cost Accounting :

Cost Accounting is simply a process necessary for the recording & reporting the computation of the cost of producing goods and offering services in a detailed format.

Compared with Financial accounting, cost accounting is a relatively modern development. The history of financial accounting can be tracked back to the early days of civilisation, whereas the technique of accounting for cost was not considered seriously until the beginning of the present century.

Before then, attention had been focused mainly upon the provision of annual financial accounts which comprised a statement of assets and liabilities in the form of a Balance sheet, and a Profit and Loss account which disclosed in terms of total profit earned, or total loss sustained, the aggregate financial result of carrying on the business during the period under review. All this information is still called for and continues to be made available by the financial accountant. But modern management now demands something more. It requires details of cost and other statistical information which enable it not only to distinguish the efficient department from the inefficient and the profitable product from the unprofitable product but will also relate good results and bad to the individual managers and others directly responsible for them. The availability of these particulars in a convenient form enables management not merely to judge the efficiency of past efforts, but also to control current operations and plans for the future. The provision of such information is the function of the cost accountant, whose status in recent years has risen progressively until his services have become indispensable to the industry, and cost accountancy may now be regarded as a profession in it’s own right.

If cost accounting is now vitally important, why was it not always so? Why did not the technique of costing develop at the same time as that of financial accounting? The answer to both these questions lies in the changing pattern of industry and commerce. Before the machine age, men pursued their respective crafts individually and they could ascertain the cost of their work by the simplest means if not entirely without recourse to written records.

The industrial revolution brought the factory and the machine, but still the ascertainment of cost presented little difficulty because most enterprises were conducted on a small scale and were owned by a single working proprietor or by two or three partners who were themselves in the closet contact with all their employees and personally undertook or supervised the operations of the business at every stage. Under such conditions nearly all expenditure could be related directly to particular jobs or products, and that which could not – nowadays called “overhead” – was insignificant in amount when compared with the total volume of easily ascertainable direct costs. It was, therefore, readily possible to obtain costing memoranda that were sufficiently complete and accurate to serve the needs of the time. As the use of machines became more widespread, however, and as the complexity and value of plant increased, the process of costing became more difficult. The proportion of overhead in total cost became greater and this fact could not be disregarded without the costing information becoming seriously unreliable.

With the development of transport facilities the scale of the average industrial concern’s activities was enlarged to cover a wider market. But it was the growing acceptance of the public and limited company that brought about the really large scale enterprise with which we are now familiar. The advent of such companies rendered possible the establishment of undertakings of a size and importance far beyond the financial resources of a few individual proprietors. The capital of many such concerns is contributed by hundreds or thousands of separate shareholders who do not manage the business but only elect directors to do so on their behalf. These companies compete for business in national markets at home and abroad, and their ramifications are often so widespread and complex that it is physically impossible for the Board of Directors or their principal executives personally to control the day-to-day conduct of the activities for which they are responsible. This being so, and as the directors are also responsible for the planning of the future policy, they need to have recourse to an efficient costing system which provides :

(a) Accurate and prompt information and cost data to place management in a position to control cost.

(b) A basics for estimates and facilities to enable the accuracy of such estimates to be checked.

(c) Reliable data upon which sound current and future management policy can be based.

Cost Control :

The primary aim of commercial concern is to make a profit. But profit does not arise automatically in the course of business: it is the excess (if any) of selling price over cost. And as, in practice, selling price is usually influenced by the competition of rival concerns or products, as well as by the strength of consumer demand and a host of their market decisions beyond the producer’s control, it follows that any success he may have in selling his goods or services profitably is likely to depend upon his ability to control his costs, and upon the extent to which he can keep them below the selling price imposed upon him by competition.

This operation can be expressed in the formula below :

• Selling Price – {Production Cost + Distribution Cost + Selling Cost + Administration Cost} = (Profit or Loss).

Definition Of Cost Control :

Cost control can be defined as the regulation by executive action of the costs of operating an undertaking, particularly where such action is guided by cost accounting. It involves the handle of material usage and material prices ; of wages cost, separating the effect of efficiency from the payment rates ; of the costs of services and maintenance ; and of all other items of indirect expenditure.

The first stage in cost control is the setting of standards or targets of performance against which the actual costs can be measured. A yardstick commonly used in the comparison is the cost record of the previous period. But this is reliable only when prices and methods remain unchanged, the volume of production is constant and the proportion of sales of various products does not change substantially from period to period. Moreover, as such comparison disregards the standard of efficiency attained in the earlier period, there is a risk of an indifferent current record seeming to be good only because it is compared with one that is even worse. A better, and more modern, plan is to compare actual performance with a predetermined budget or standard, expertly drawn up to show what expenditure should be incurred, or what a product ought to cost under conditions of high efficiency. This is the method of Budgetary Control and Standard Costing which will be described in the next contents.

Costing As A Basics For Estimating :

Although selling prices are frequently regulated by conditions beyond the supplier’s control, this is not always entirely so. In some businesses, and for contract and jobbing work, for example, firms are commonly invited to submit quotations or estimates for the supply of specified goods ad services. When this happens, the supplier will quote a price based upon the formula below :

• Production Cost + Distribution Cost + Selling Cost + Administration Cost + Profit = Selling Price.

Resource to cost records will give the estimator useful information about the cost of the previous jobs of similar kind and other statistical details that will facilitate the drawing up of trustworthy estimate. The amount he would include for profit will be determined with due regard to the custom of his trade and to any relevant special factors, such as the state of his order book.

Once a customer has accepted a quotation, this determines the selling price of the goods regardless of the costs subsequently incurred. The actual costs will, however, be recorded, and for the purpose of contrast will be compared with the estimate on which the quotation was based.

Costing As A Basis For Operating Policy :

Almost every decision made by the management had repercussions upon cost, and it’s a function of the cost accountant to show the probable financial effect of alternative courses of action. Thus, he may be called upon to prepare a statement comparing the cost of buying a particular service from an outside supplier with that of providing it internally, in order to assist management in deciding upon the best policy to adopt. When such a policy decision has been made, the cost accountant will trace the actual results and provide data comparing them with those anticipated. In the presentation of information of this type the cost accountant has great scope for the exercise of ingenuity and skill, particularly as the average manner is not a trained accountant and needs clear, concise statements that he can readily understand.

Advantages Of Costing :

In addition to fulfilling the objective referred to above, a costing system will provide the following benefits to management :

(a) The relative profitablity of various activities will be revealed, and management this given the opportunity to review them and to consider the elimination or modification of those from which little or no advantage is derived.

(b) The disclosure of unprofitable or excessively costly operations may lead to the development of new or improved methods.

(c) Cost accountants will reveal the cause of any increase or decrease in the profit shown in the financial accounts.

(d) Since an adequate system of material and wages accounting is a pre-requisite of a sound system of costing, some control over these items of expenditure will be ensured.

(e) Management will be informed of the unabsorbed overhead expenditure that arises when plant is not employed to capacity and will be able to modify it’s policy accordingly.

(f) Information will be forthcoming to enable management to compare the probable results of alternative courses of action, e.g., as to whether it is more profitable to produce a component or to buy it from a manufacturer who specializes in it’s production.

(g) When the various concerns in a particular industry agree to record their cost uniformly and to submit their results to a trade association or to an independent public accountant, information of the outmost value to the members of the industry can be exchanged without prejudice to the interests of the individual members concerned.

(h) Where running contracts provide for the adjustment of an agreed price in the event of a change in costs, the records of an efficient costing system can be employed to facilitate the acceptance of a new price by customers.

Designing A System Of Cost Accounts :

The keynotes of a good system of cost accounts are simplicity and common sense. The simple record and the clear form of control that can be easily be understood by all concerned, are always more effective than the over-complicated system that provides a mass of information the signature of which is only vaguely understood by those to whom it is presented.

Before a costing system is installed, therefore, a great deal of consideration is called for, and much planning needed. In particular, the business must be studied in detail to find out exactly what information is required and to ensure that the obtainable results will justify the cost of the additional staff and records involved. Clearly, the design of a system of cost accounts, and the details of the methods to be employed, will vary widely according to the individual features of each concern. But whatever the nature or size of the undertaking, the system must, above all, be designed to suit it precisely and be as straightforward as possible. If this is done the time and money devoted to it will be a profitable investment.

Applications Of Costing :

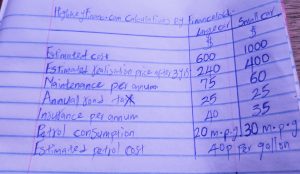

While cost accounting is generally looked upon as a feature of manufacturing concerns, it’s applications are in fact much wider. For example, the principles of cost accounting are applied successfully in the wholesale and retail trades, in road transport undertakings, and in farming. Costing not only provides the fact from which policy decisions can be made, but the basic principles of costing can be applied alike to the transactions of large and small undertakings and even to those of individuals. For example, a man decides to buy a second-hand car and is offered a large car and a small one. He finds that the small car is economical to run but more expensive to buy than the large one which gas a comparatively heavy petrol consumption. Look at the illustration below :

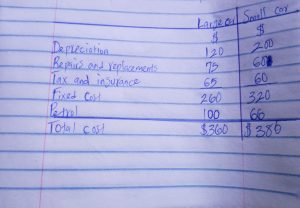

For an estimate of 5,000 miles a year the comparative costs will be :

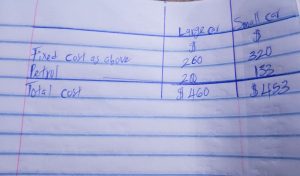

For 10,000 miles per annum the costs will be :

From this information the prospective purchaser can see that if he intends to run 5,000 miles per year the large car will be slightly cheaper. At 10,000 miles the balance favours the smaller car. The costs will break even when the difference in petrol consumption equals the difference in fixed costs ($60), i.e., at 9,000 miles a year.

It is significant that part of the cost in the above example is largely fixed regardless of mileage, whereas the petrol cost varies directly with the miles run. This is a most important feature of costs which is referred to in detail later on. Most costs are either fixed or variable, although some contain elements of both classes and are termed semi-variable (or semi-fixed) costs. The car repairs and replacements fall into this category because the cost tends to increase with mileage, although the increase in the former is not necessarily proportional to the increase in the latter.

Ignoring interest on capital, it will be seen that in the case of the large car the cost per mile for 5,000 miles is 7.2p, whereas for 10,000 miles, it falls to 4.6p. This is because $260 of the cost is fixed regardless of the mileage. The cost might be stated as: Assuming that the large car is bought and the fixed expenditure incurred, it will cost the owner only 2p for every mile he runs. Accordingly, in considering whether he and his wife should travel by car or take the train for a particular journey, he will calculate the comparative as follows :

• Rail fare for a round trip of 100 miles for two persons (say) = $3.

• Running cost of car : 100 miles at 2p per mile = $2.

As tax, insurance, etc., must be paid regardless of mileage, it would not be appropriate to use the total cost of 4 – 6p per mile.

Relationship Of Cost Accounting And Financial Accounting :

The distinction between the objectives of cost accounts and financial accounts at first resulted in the use of two entirely sperate accounting systems each producing a figure of profit or loss which, for a variety of reasons, did not agree with the corresponding total disclosed by the other. Since this state of affairs was manifestly unsatisfactory, the practice has grown of reconciling the two sets of accounting records and, more recently, of employing a system under which they are completely integrated.

This has happened at a time when management is taking a keener interest than formerly in the class of information which accountants provide. It is natural, therefore, that both cost accountants and financial accountants should have been encouraged to devote much attention to the development of new methods and to the provision of information that will assist management in day-to-day running of the business.

After a period of growing divergence, the two branches of accounting are thus being brought together again, and there has emerged a new figure, not wholly financial accountant, not entirely cost accountant, but a combination of the two known as management accountant.

In conclusion, this contains necessary information concerning cost accounting, costing and other related finance term, take your time to study it. Learn more about finance here. Incase you want to ask any questions feel free to use the comment section below.

1 thought on “Introduction To Cost Accounting – Definition Of Costing, Cost Control”